Tax Brackets 2025 Single. Due to inflation, the tax brackets increased by 5.7%. These adjustments are made annually to account for inflation and ensure the.

For 2025, the standard tax deduction for single filers has been raised to $15,000, a $400 increase from 2025. You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax years.

Us Federal Tax Brackets 2025 Dale Mignon, Let’s say for the 2025 tax year (filing in 2025), you earned a taxable income of $90,000, and you filed as single.

Tax Brackets 2025 Single Ebonee Cherianne, In 2025 and 2025, the income tax rates for each of the seven brackets are the same:

2025 Standard Deduction For Married Couples 2025 Suzi Yevette, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax years.

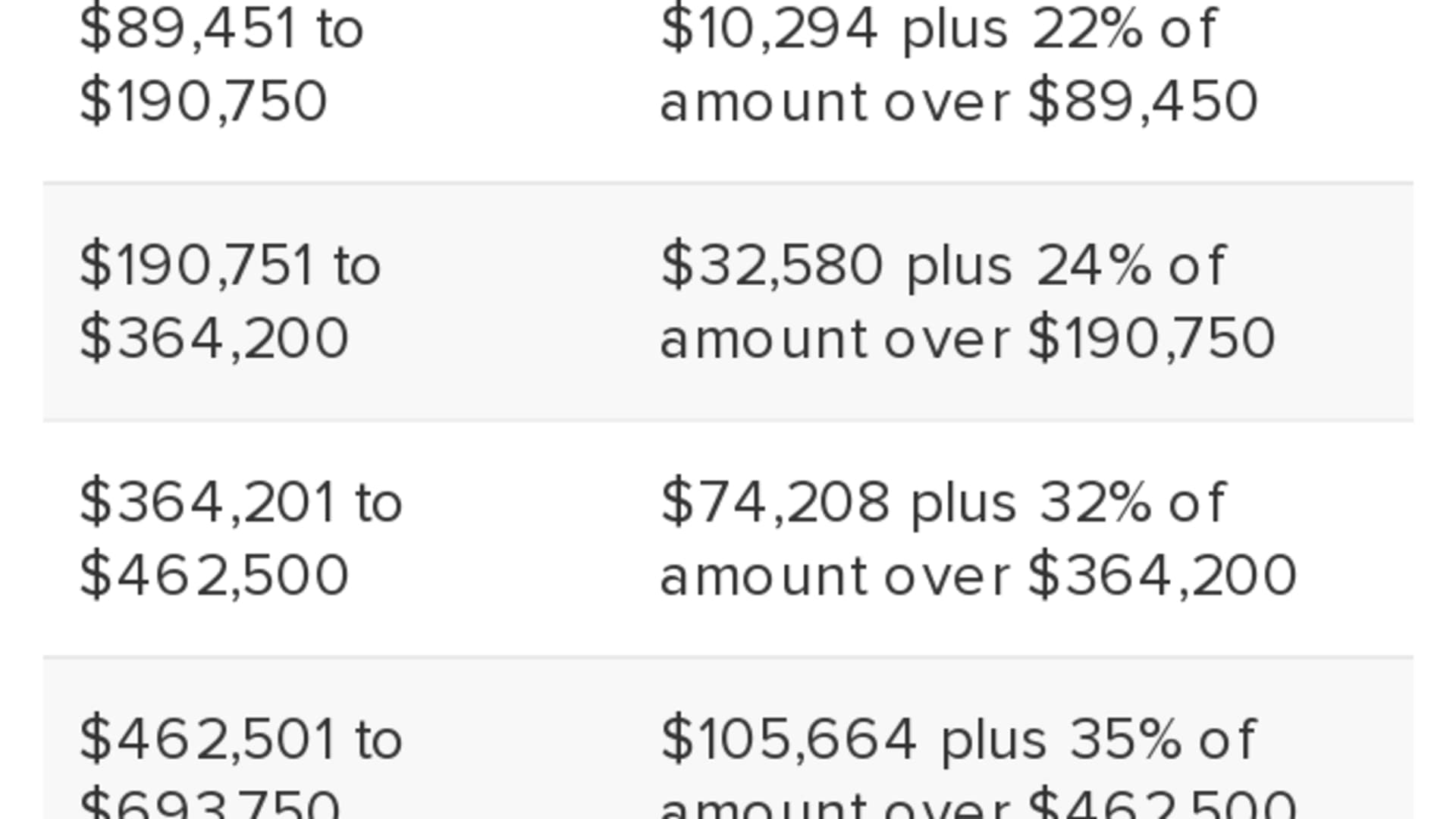

Az Tax Brackets 2025 Arlena Olivia, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Brackets 2025 For Single Person Drusy Sharon, Your filing status and taxable income, including.

Here’s how advisors are using Roth conversions to reduce taxes for, There are currently seven tax brackets that you might fall into:

Single 2025 Tax Brackets Chart Leone, Learn how marginal tax rates work, see tables for all filing statuses, and understand changes.

Really? My Bonus is Taxed the Same as my Paycheck? — Human Investing, There are seven (7) tax rates in 2025.